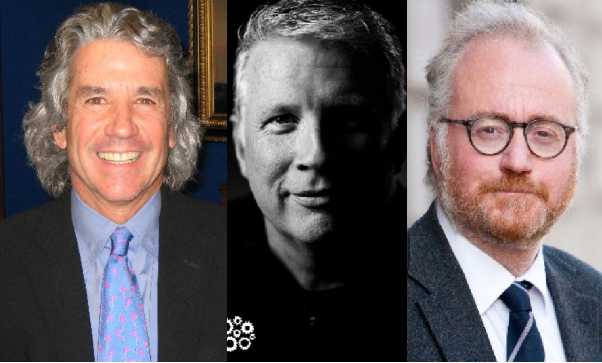

Russell Napier — The Rise And Fall Of The Age Of Debt

Blockworks Macro, Released on 3/26/24 Russell Napier, founder of Orlock Advisors and publisher of The Solid Ground Newsletter, returns to Forward Guidance to share how China’s decision to peg its currency the Chinese Yuan in 1994 at an artificially low rate had enormous consequences on world’s monetary system, and why China may be soon be […]