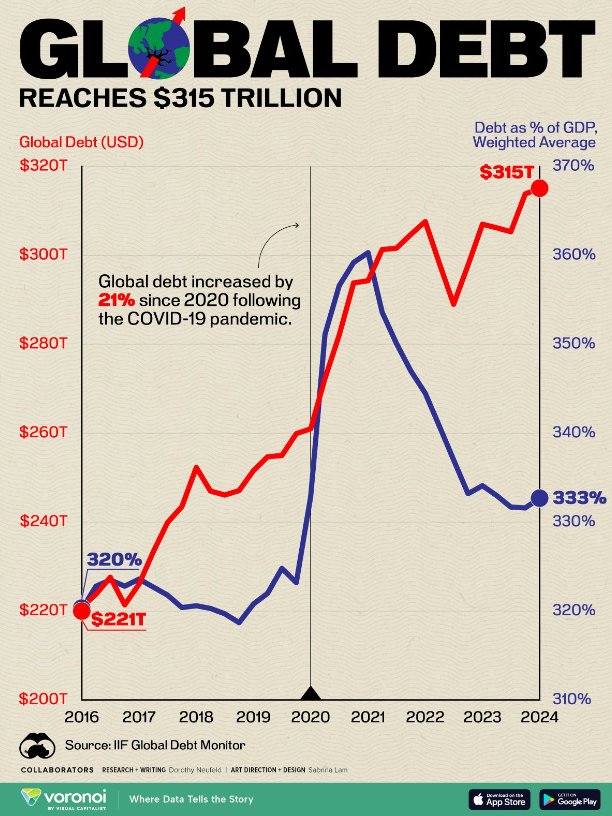

Mario Nawfal – X, Released on 1/16/25

The world’s debt hit a jaw-dropping $315.1 trillion in early 2024, climbing $1.3 trillion in three months! Debt now equals 333% of global GDP. The U.S. and Japan led the borrowing frenzy in advanced economies, while China, India, and Mexico carried the torch for emerging markets. Since the pandemic, global debt has ballooned by $54.1 trillion, up 21%. Non-financial companies owe $94.1 trillion, governments $91.4 trillion, financial institutions $70.4 trillion, and households $59.1 trillion. In the U.S., debt servicing costs now outpace defense spending, and guess what, there’s no plan to fix it (Maybe DOGE will step up to the plate?). Meanwhile, emerging markets face rising risks with $105 trillion in debt and sluggish recovery from 2019.

Source:visualcapitalist – Aug 2024

That fact is wrong The total global debt is 2,5 Quadrillion when unfunded liabilities are figured in !

Unfunded liabilities at least in theory can be eliminated. The bonded debt can’t be defaulted on unless the government goes bankrupt. If that happens say goodbye to your bank account including your checking account

Again, if the money is phony so is the debt. To solve it all you have to do is reset everything back to ZERO.

Be a nimpcompoop like me, every once in awhile.

You’re not wrong

About a year ago the total debt was reported to be about $309 Trillion, while the total collateral backing up these loans was about $217 Trillion. If you think it’s crazy for a bunch of bankers to issue more debt than there’s real value backing up the loans, you’re not thinking like a banker!

Who holds the debt? I’m thinking a certain demographic……

DEBT TO WHOM EXACTLY!?

BULLSHIT!

To those with the largest debt, and who can leverage that against you defaulting first, thus buying up your real assets. You’ll own nothing and be happy. Don’t forget, it’s not the wolves who eat the sheep, it’s the shepherd.