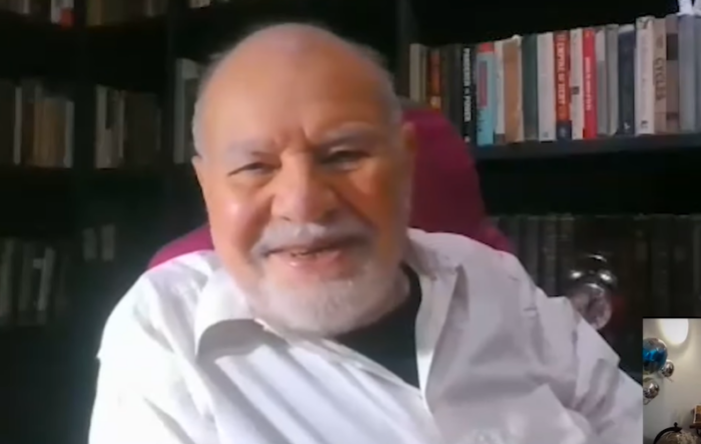

Andrew Maguire: China Trumps Silver

Kinesis Money, Released on 4/4/25 In this week’s Live from the Vault, Andrew Maguire discusses how China’s strong physical silver buying is challenging the paper market, with liquidity providers exploiting the widening EFP spread to push the market towards physical settlement. As Chinese and Indian demand intensifies, it unfolds a structural shift in the silver […]